Malaysia’s halal industry is one of the country’s most robust, expected to contribute 8.1% to the country’s total GDP. According to Statista, around 63.5% of the total Malaysian population identified as Muslim in a 2020 study, making the halal market a pivotal sector for Malaysian business and economic growth.

As the world settles into a post-pandemic era marked by accelerated digital transformation and shifting consumer needs and behaviors, growing Malaysia’s halal industry also depends on embracing these changes and prioritizing growth areas through public-private sector partnerships and adopting digital solutions for optimization and productivity.

An Overview of Malaysia’s Halal Industry Areas

The Global Islamic Economy Report, an annual publication released by Islamic insights provider Salaam Gateway, defines the “Islamic Economy” as sectors comprising core products and services that are affected by Islamic law and ethics. YCP Solidiance Malaysia Manager Adeline Ooi and Associate Benjamin Yong have categorized these sectors into four major areas:

- Halal Food, Pharmaceuticals, and Cosmetics: As guided by Islamic law, there is a specific way to slaughter permitted animals that is deemed permissible or “Halal.” Items such as pork and its by-products, alcohol, and other intoxicating items are not allowed to be consumed and are categorized as impermissible or “Haram.” These rules apply not just to food, but to other ingested and topical items such as pharmaceuticals and cosmetics, with most Muslim-majority countries having laws in place specifically to ensure that these items are Halal-certified.

- Islamic Finance: Several guidelines are outlined in the Qu’ran and Sunnah to ensure fair business deals and transactions without the involvement of interest and usury. Islamic finance is a major category in the Islamic economy and deals with banking, capital markets and asset management, and insurance. When it comes to business dealings, it is vital to ensure that the transaction terms are clearly defined and unambiguous according to Islamic principles.

- Garments and Fashion: Both the Qu’ran and Sunnah emphasize modest clothing, which is reflected in many common Muslim garments through longer lengths, more body coverage, and opaque, non-transparent fabric. Sustainably made and ethically sourced items are also gaining popularity and importance among Muslims as suitable criteria for choosing clothing.

- Tourism and Media & Recreation: The values of avoiding unlawful activities such as gambling and drinking alcohol is important for Muslims when planning trips and recreational activities, as outlined in the Qu’ran and Sunnah.

Based on the aforementioned report, Malaysia ranked #1 for the ninth consecutive year through its high scores in Islamic Finance, Halal Food, Muslim-friendly Tourism, and Media & Recreation. It also ranks #2 and #9 in Pharmaceuticals and Cosmetics & Fashion respectively, highlighting just how much commitment the Malaysian government and companies have put into growing the industry. This, in turn, translates to more opportunities for businesses to enter and succeed in the market.

Growth Areas and Recommendations for Malaysia’s Halal Market

Malaysia is focused on developing its Islamic Finance and Halal Food sectors—the two largest industries in the world—via several partnerships with both local institutions and foreign developers.

In the Islamic Finance sector—which sustained a 9% increase in Islamic Finance assets and 20% growth in total value in 2021—fintech is proving to be a promising key growth area due to shifting consumer behavior stemming from the COVID-19 pandemic. Financial institutions are now looking to develop remote, contactless services: an example is Ethis, considered to be Malaysia’s first Shariah-compliant fintech company focused on ethical crowdfunding in accordance with the laws of Islam. The overall growth of fintech and the continuing acceleration of digitalization in Malaysia presents market opportunities for players wanting to enter the halal market and carve out their own space within the industry.

When it comes to Halal Food, the Halal Development Corporation (HDC), a federal government agency that oversees the country’s halal industry, has designated 14 strategic locations for Halal Malaysia Industrial Parks (HALMAS). To be accredited as a HALMAS, industrial park operators must comply with HDC requirements for halal park development, and can enjoy further incentives such as trade and investment facilitations. Currently, HALMAS parks encompass around 200,000 acres of land and host multinational corporations such as Kellogg Asia, Cargill Palm, F&N Dairies Manufacturing, and Coca-Cola Bottlers.

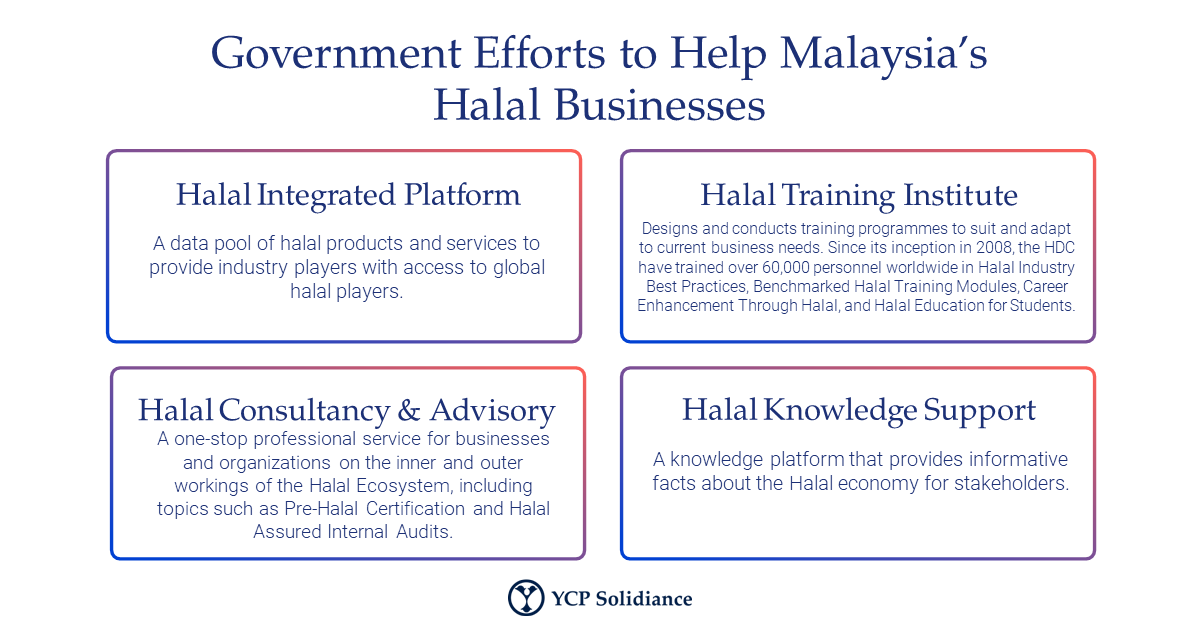

Malaysia’s halal industry has also been designated as one of the focus areas in the 12th Malaysia Plan (12MP), a post-2020 national development plan to ensure meaningful socioeconomic development for the next decade. The Malaysian government is targeting 56 billion RM in export revenue for the halal industry by 2025, and has created a robust ecosystem to support businesses involved in this sector.

Malaysia’s high ranking in the Global Islamic Economy Report, coupled with its government’s commitment to further developing the sector, make the country a prime location for local and foreign companies to invest in halal operations. YCP Solidiance Manager Adeline Ooi has the following recommendations for stakeholders who want to make the most of this boom:

- Existing local companies or foreign companies operating within the FMCG and Finance sectors should consider diversifying their products and services to fit both local demand and that of other Muslim-dominant areas such as Indonesia and the Middle East. Alternatively, M&A is also an option to be explored for diversification, especially for medium to large companies. .

- For new local entrants, building a niche business model catering specifically to halal consumers would be beneficial, especially in the areas of tourism and media that require a low starting capital.

YCP Solidiance can aid both local and foreign companies interested in entering Malaysia’s halal sectors. Through our expertise in market research into a wide range of industries, our experience in end-to-end FA service, and our strong local team, we can provide business strategy and insight into diversification, market entry, and other services to ensure success in the halal industry.

For more insights into Malaysia’s business industries, subscribe to our newsletter here, or read the following reports: