As the Middle East construction industry navigates its post-pandemic recovery, the Kingdom of Saudi Arabia (KSA) is being touted as the region’s leading construction market due to several factors such as data trends, growing investor interest, and the country’s long-term commitment to bolstering construction efforts.

According to data from Trade Arabia, the Saudi construction market is forecasted to perform well in 2022 as its initial value was already at 37 billion USD only two years prior. Given that the sector also registered an estimated CAGR of 5.2% for the period 2021 to 2026, the Saudi Arabian construction industry is exhibiting promising potential.

Saudi Vision 2030

Part of the reason why the Saudi construction industry is expected to perform well in 2022 is because of the goals set forth in the Saudi Vision 2030 initiative. In Saudi Arabia’s attempt to diversify its economy by becoming less reliant on oil resources, the construction sector will play an essential role.

Specifically, to increase non-oil government revenue, the country is adopting a long-term economical outlook focused on increasing domestic consumption while also strengthening the development of the private sector. Via the construction market, this may be achieved by capitalizing on specific trends, such as building infrastructure with the growing and digitally engaged population in mind. In the YCP Solidiance white paper “Partnering for Success in Saudi Arabia Construction,” the following key trends that will drive development in the KSA have been identified:

- GDP Recovery – The COVID-19 pandemic led to a 14% decline with a loss of 112 billion USD in 2020, but the Saudi GDP is expected to rebound quickly. With a growth rate of approximately 5.6% between 2020 – 2025, the 2025 annual GDP is forecasted to reach 895 billion USD.

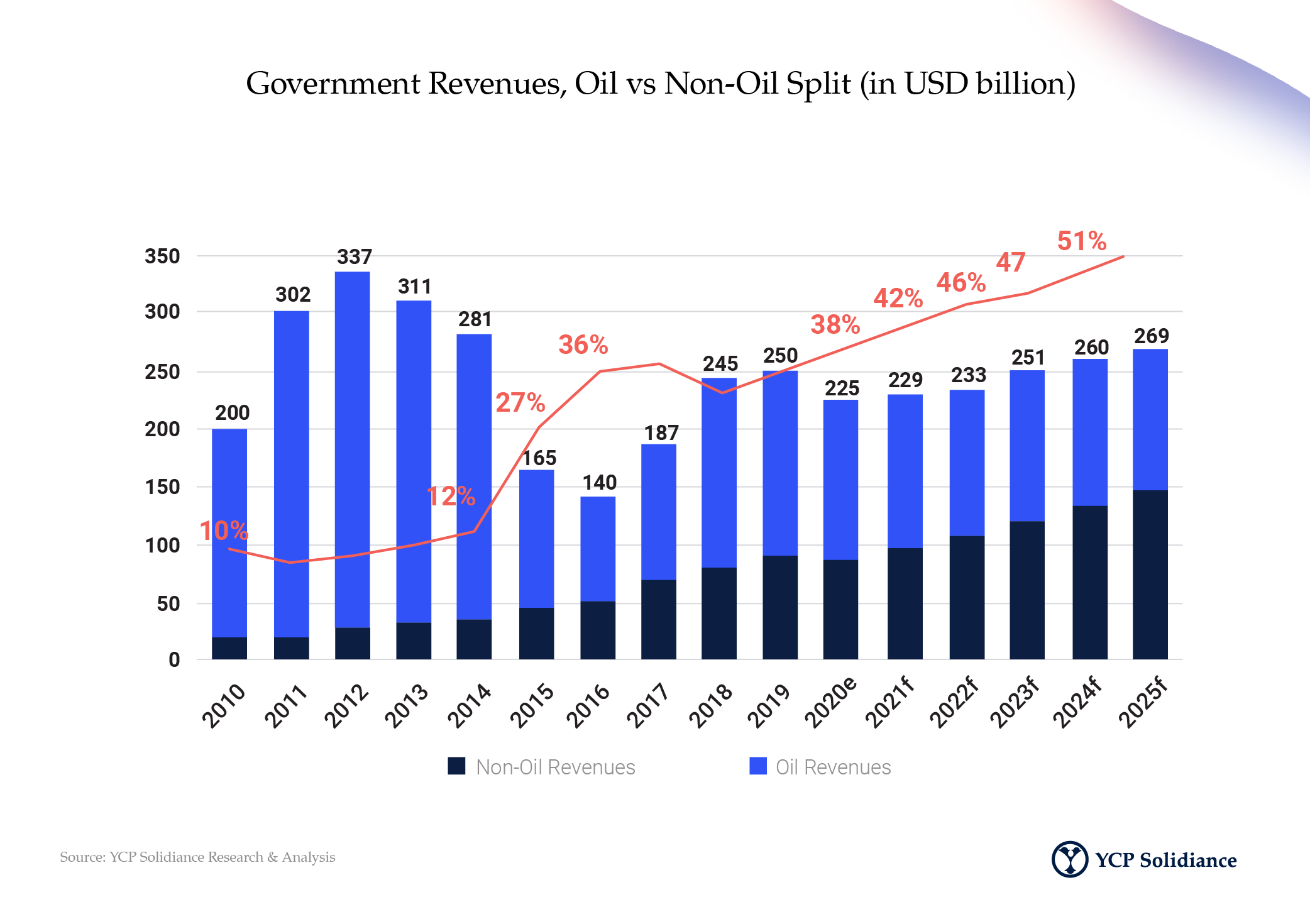

- Commitment to Diversifying – Traditionally, KSA’s economy has been heavily reliant on oil as a source of revenue. With the government expressing a desire to diversify via exploration of non-oil sources, this trend is expected to drive mass development throughout the country.

- Saudi Vision 2030 – To ensure that economic diversification takes place, the government has firmly implemented Saudi Vision 2030 as a strategic framework. Primarily supported by the Public Investment Fund (PIF), projects developed within the private sector are expected to spearhead diversification efforts.

- Developmental Needs – In 2020, Saudi Arabia’s population was approximately 35 million and it is expected to increase further as recent data suggests it will reach 45 million by 2050. Thus, addressing the needs of the growing urban population will likely be a significant factor in dictating construction market trends in the coming years.

- Foreign Investment – Putting an emphasis on transparency and compliance, the KSA government will look to drive foreign investment in the domestic construction market. Doing so will not only strengthen global presence but also motivate private sector participation.

Steps to Public-Private Partnership

While initiatives like Saudi Vision 2030 and key drivers for long-term KSA development are important to the Saudi construction market, other factors will also play a major part. Namely, public and private partnerships between both domestic and international parties are expected to bolster growth.

Before parties concerned with Saudi construction engage and collaborate by entering partnerships, some considerations must first be made. For foreign contractors, although the investment landscape has improved considerably in KSA, there are still risks that should inform investment decisions. The risks have been categorized as the following:

- (1) Contractual – Both local and international contractors must abide by the use of standardized work contracts and penalty fees. Although these are within reason, there are concerns regarding the contract termination rights maintained by the government under certain restrictions.

- (2) Workforce – Some labour laws are favorable to foreign entities that engage in public works wherein specific instances require foreign investors to forfeit 30% of work contracts to Saudi nationals. Certain accreditation procedures must also be met, such as on-site visits for permits but overall, these processes can easily be expedited.

- (3) Liability – Local laws create beneficial exclusions and caps surrounding the liability of parties, such as Saudi policy forbidding consequential or dubious damages to parties.

- (4) Other – General circumstances make it difficult to invoke Force Majeure clauses, but there are other difficulties that can cause potential concern. For example, although contractors may request payment advances, full payment may only be secured via contract fulfillment. Thus, contractors involved in private sector work may suspend work until payment is issued.

Although these factors are important to consider as they carry a degree of risk, potential entrants should not be deterred from exploring the KSA construction industry. As affirmed by the commitment of the public and private sectors’ willingness to sustain development, the sector’s potential is immense as it presents several promising investment opportunities. As early as now, parties should proactively seek out possible partnerships as doing so could facilitate entry into the Saudi construction market.

To learn more about the other business trends in Saudi Arabia and what opportunities these developments are presenting, subscribe to our newsletter here and check out these reports: