In line with current efforts to scale financial technology or fintech, within the country, the Kingdom of Saudi Arabia (KSA) opened the Financial Technology Center in Riyadh City last March 2022—a project that aims to accelerate fintech investment for entrepreneurs and investors alike.

Given that the fintech sector in Saudi Arabia generated approximately 157 million USD within the first eight months of 2021, several initiatives have been launched to sustain such impressive growth.

A Saudi Cashless Society

While the launch of the Financial Technology Center is a significant milestone in Saudi Arabia’s fintech journey, efforts to scale growth have been well underway for many years. As part of the Saudi Vision 2030 initiative, which was launched in 2016, one of the key steps to diversifying its largely oil-dependent economy would be to leverage the advantages of fintech.

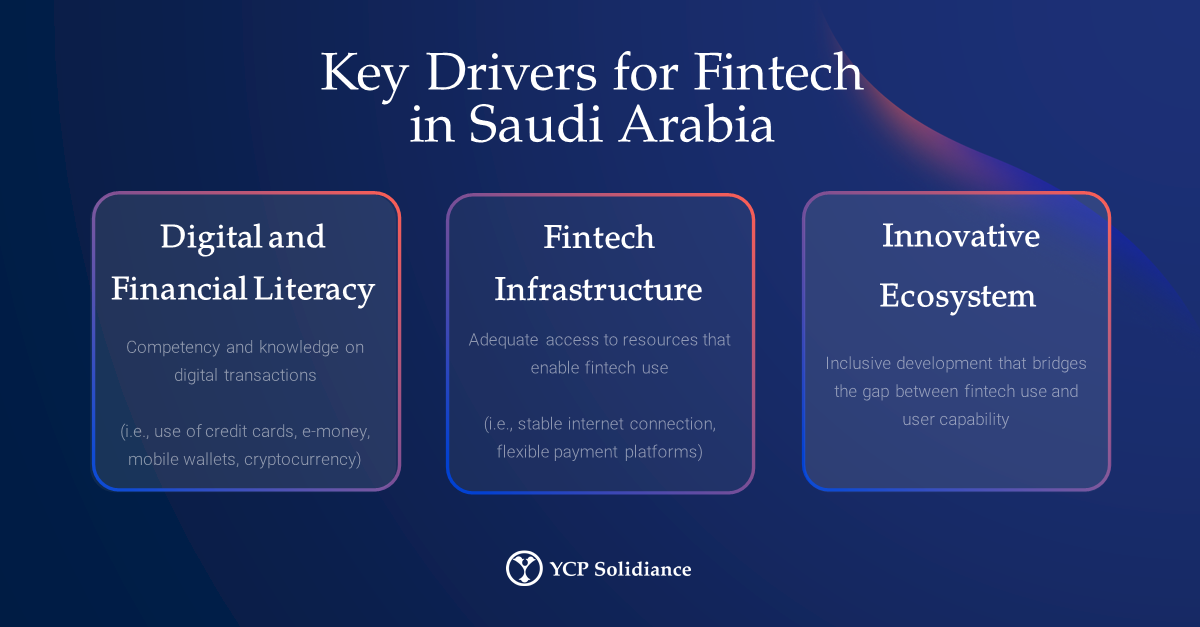

In the YCP Solidiance white paper “Saudi Arabia’s Road Toward Becoming a Cashless Society by 2030,” three key elements that will help facilitate KSA’s goal of becoming a predominantly cashless society were identified. Namely, (1) the population must become digitally and financially literate; (2) adequate infrastructure in the form of reliable internet and payment platforms; and (3) a fintech ecosystem that promotes healthy, long-term innovation.

With these elements in mind, it is important for new and existing Saudi Arabia fintech entrants to consider these factors when making investments. Further, the identification of these areas also poses a promising business opportunity as the entry of both small- and large-scale businesses could potentially create a significant impact, especially since fintech in Saudi Arabia is still in early-stage development.

Accelerating Fintech in Saudi Arabia

To better understand which areas of fintech have the best investment potential, players should align their interests with and inform decisions based on emerging industry trends in Saudi Arabia. For example, in the YCP Solidiance white paper “Transforming Saudi Arabia into the Middle East's Logistics Powerhouse,” research revealed that trending industries usually involved the application of digital solutions like robotics and artificial intelligence (AI).

As early as now, the utilization of such tools can already be seen in the Saudi Arabian fintech industry. As reported by Arab News, several fintech firms have focused on mobilizing through digitalization by diversifying the services offered. For instance, in anticipation of launching operations in the KSA, Egypt-based fintech firm FlapKap seeks to provide customers with AI-based, actionable financial insight that is derived from data analytics.

Although the application of complex digital tools in the context of fintech is trending among larger companies, smaller players like MSMEs can still capitalize on fintech solutions, especially amid rapid digitalization. Specifically, businesses in other industries like retail or the food industry could actively seek out and explore ways to integrate fintech solutions like mobile payments and platforms to operations.

Considering the rapid pace at which Saudi Arabia is scaling its fintech industry, as well as the plethora of opportunities available to old and new entrants alike, expect continued growth in the coming years. Given the high level of sustained interest surrounding fintech in Saudi Arabia, both domestic and international investors should capitalize as early as possible.

To understand how other countries are developing their respective financial technology industries and what implications this may have on how businesses operate, subscribe to our newsletter here and check out these reports: