What should businesses and professionals in Singapore expect in the second half of 2022? As part of a new series, YCP Solidiance will be releasing several in-depth articles that revisit previously analyzed emerging business trends in Singapore, guided by research and analysis from our team of professionals in the country. Read the first installment here.

To better understand how digitalization in Singapore is progressing for Q3 and Q4 in 2022, read the second installment below and subscribe to our newsletter here.

At the onset of 2022, digitalization was slated to play a crucial part in Singapore’s business industries, especially in the coming years. Our initial report concluded that digitalization was not merely a trend, but rather a movement with immense staying power.

Now, as we enter the last few months of 2022, the same can still be said—but the focus has shifted toward sustaining the digitalization growth that was achieved over the course of the COVID-19 pandemic.

Progress of Digitalization in Singapore

In terms of digitalization efforts within the country, the Singaporean government continues to play an active part. Aside from previously established domestic digitalization programs, the government has further cemented its long-term commitment to digitalization by allocating approximately 200 million USD in its national budget for 2022. This indicates that innovation and improvement of technological capabilities— wherein digitalization plays a major role — is a significant priority in Singapore for both the private and public sectors.

Moreover, certain industries concerning digitalization have witnessed pronounced success at the start of H2 2022. Specifically, the robotics industry is growing rapidly as evidenced by the ~20% robot deployment rate; well above the global rate of 16%. While this data was initially registered between 2010 and 2015, the trend has translated well in recent years as leveraging robotics helps address issues such as manpower shortages amid a tight labor market.

With both the short and long-term in mind, Singapore is looking to sustain digitalization growth via several important initiatives with specific targets. The following key digitalization initiatives include:

- Advanced Digital Solutions: Specific targets include providing support to and helping equip SMEs and large enterprises in the construction industry with the capability to integrate robotics and automation in processes— be it general or specialized tasks.

- Grow Digital Scheme: Give SMEs further access to untapped overseas markets through digital platforms, while focusing on possible expansion opportunities.

- Improving Infrastructure: Continue to build a solid foundation for digitalization by investing in improved broadband and connectivity infrastructure. This is guided by the goal of increasing internet speed tenfold in the coming years, while also gradually shifting toward 6G technologies.

- Increased Integration of Technology: Encourage businesses in Singapore to take advantage of digital solutions like robot operating systems (ROS). Doing so may improve capability, maximize profits, and increase the take-up rate of tech.

Exploring Digitalization Trends

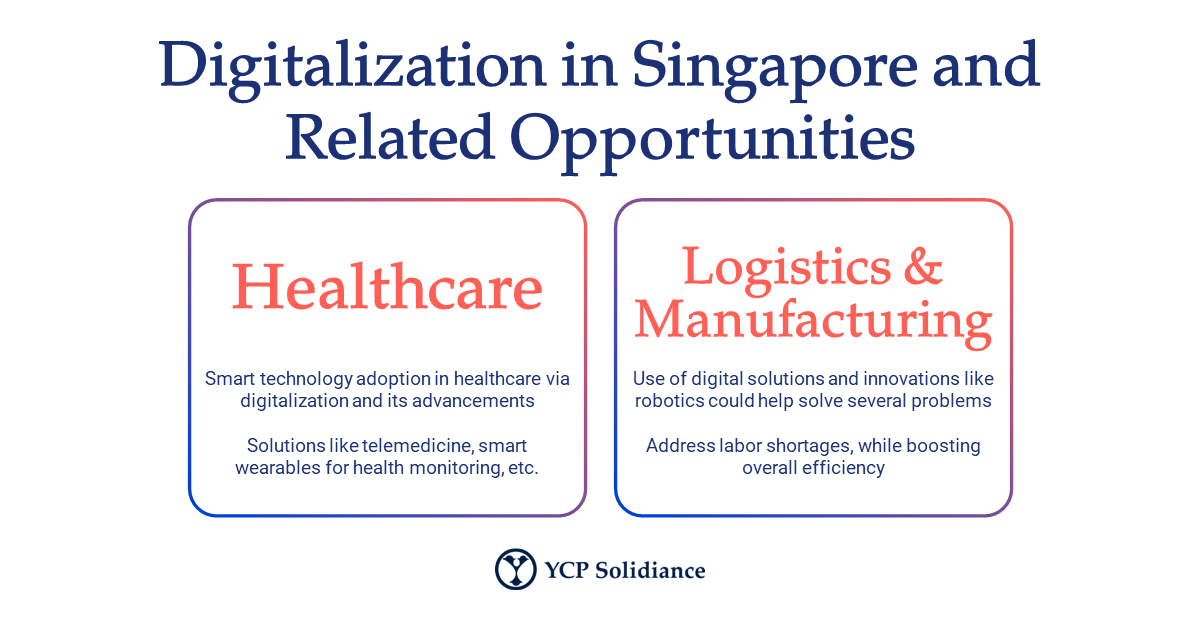

Given that Singapore continues to invest in digitalization and related advancements like robotics, more and more opportunities will likely emerge in the coming years, especially when considering that several industries can flexibly utilize digitalization. For instance, in robotics, manufacturers and logistics players can utilize robotics to maximize the efficiency of warehouse operations.

Aside from this, businesses in the healthcare industry can also benefit from digitized solutions like automation, artificial intelligence (AI), and big data. An example from another SEA country is found in the YCP Solidiance white paper “The Future of Smart Hospitals in Thailand.” Data found that the integration of smart technologies like AI Chatbots, Telemedicine, and remote monitoring in Thai hospitals provided advantages such as increased efficiency of day-to-day operations and improved labor management. Considering that Thailand is a Southeast Asian neighbor to Singapore, healthcare operators located in the latter could use this framework as a guide on how to seamlessly adopt digitalization practices.

Meanwhile, for SMEs, digitalization provides the opportunity to access digital networks that will serve to expand the reach of their businesses. Further, the use of digital platforms and related technology will equip SMEs to better compete with larger enterprises. Moving forward, encouraging SMEs to increase their digitalization efforts will be emphasized within Singapore.

All things considered, digitalization in Singapore remains a significant priority; not only for Q3 and Q4 of 2022 but also in the long term. Interested parties and potential investors should be confident in exploring business opportunities concerning digitalization as indicators suggest that Singapore is proactively aiming to become a more digitalized and innovative nation.

To get further insight into emerging digitalization trends in Asia, subscribe to our newsletter here and check out these reports: