Malaysia’s financial sector has now included financial technology, or fintech to become one of its central areas of focus given its potential for rapid expansion. Malaysian consumers and businesses are prepared to adopt fintech, especially when considering the country's increasing middle class, high mobile phone usage, and strong government assistance for economic modernization.

In Malaysian fintech, digital payments and e-wallets are paving the way, bolstered by emerging trends and developments like artificial intelligence and machine learning, digital transfers, cryptocurrency, crowdfunding, and other kinds of financial innovations.

The Emergence of Fintech in Malaysia

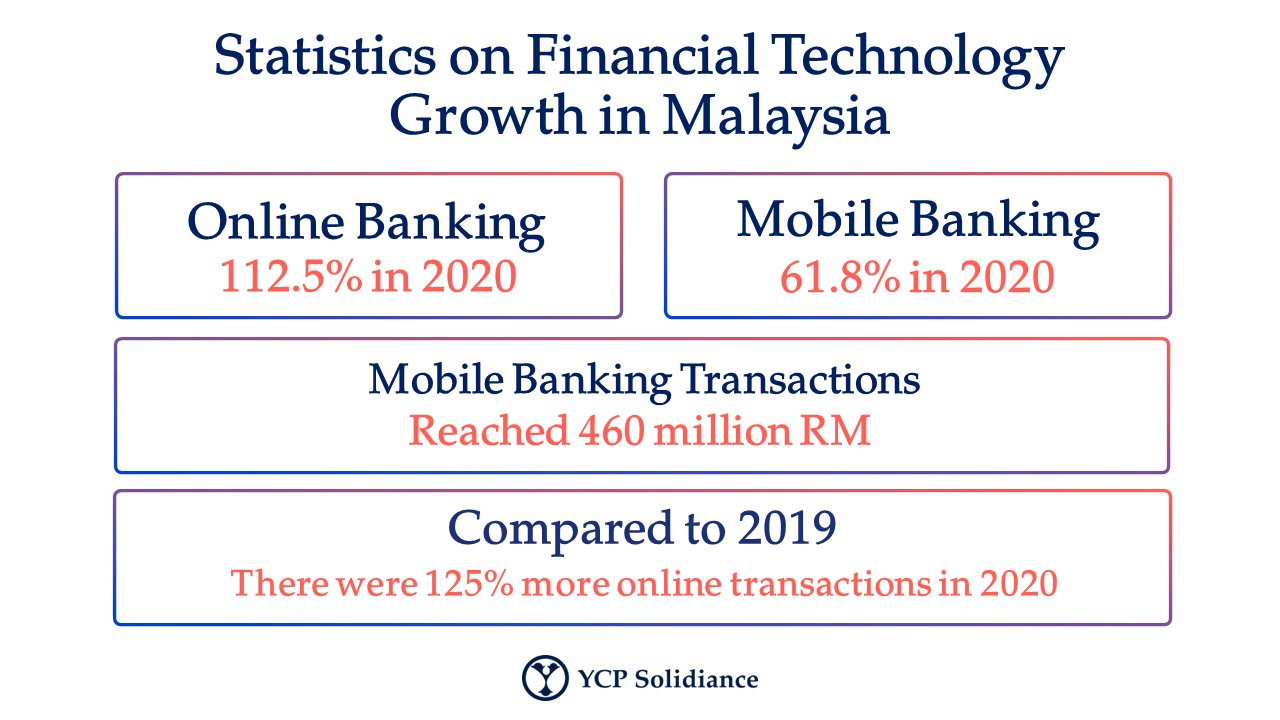

According to Mordor Intelligence, internet banking in Malaysia has increased in comparison to the previous decade. With the 4G advancements and the existence of low-cost data plans, mobile banking has shown immense potential in its application as it can be done anywhere and at any time. With commercial banks opting to downsize their branches and ATMs, this has also led to the rise of mobile and online banking. Initially reluctant to fintech, financial institutions have begun adapting and adjusting as per data from the 2019 World Economic Forum's Network Readiness Index wherein Malaysia placed #1 among emerging and developing Asian countries.

In comparison to other countries in Southeast Asia, Malaysia is emerging as one of the most developed fintech landscapes. According to Fintech Malaysia, online payments and transactions contributed to the national GDP by 20% in 2020, which has significantly boosted the country’s economic outlook. The public sector has capitalized on such development via government initiatives that aim to generate more jobs in the fintech sector, thus alleviating growing unemployment rates.

This growing interest in fintech has paved the way for several developments in recent years. One specific example is the establishment of the Malaysia Digital Economy Corporation (MDEC), a government agency that aims to accelerate the growth of the digital economy in the country. This has included initiatives to promote fintech innovation, such as the establishment of the Malaysia Fintech Hub, which provides support and resources for fintech startups. Other examples include the roll-out of digital banking and e-payment services, the expansion of online lending platforms, and the adoption of technologies such as blockchain and artificial intelligence.

Drivers of Fintech Growth in Malaysia

The fintech sector thrived greatly in 2020 and 2021, as the COVID-19 pandemic increased the demand for digital advancements to replace the physical interactions between businesses and consumers. Moreover, several factors have contributed to the growth of fintech in Malaysia, namely: (1) government support and related initiatives, (2) a large market due to expanding population with high digital aptitude, (3) a favorable regulatory environment for fintech companies and consumers, and (4) increased demand for financial services. Naturally, these drivers have translated into the rapid expansion of the sector.

According to the Fintech News Malaysia Fintech Report 2021, there are approximately over 250 fintech enterprises in Malaysia. These firms will seek to capitalize on the mobile banking surge, which will inevitably lead to the continued adoption of digital transformation trends that are in line with consumers’ digitally led lifestyles. Stakeholders should expect fintech companies to continue to dominate in the coming years as related industries like retail and e-commerce will also leverage fintech developments.

Looking ahead, it is likely that the fintech sector in Malaysia will continue to grow and evolve, as more financial institutions adopt innovative technologies to meet the changing needs of their customers.

To get insight on fintech trends that are currently emerging in Asia, subscribe to our newsletter here and check out these reports: