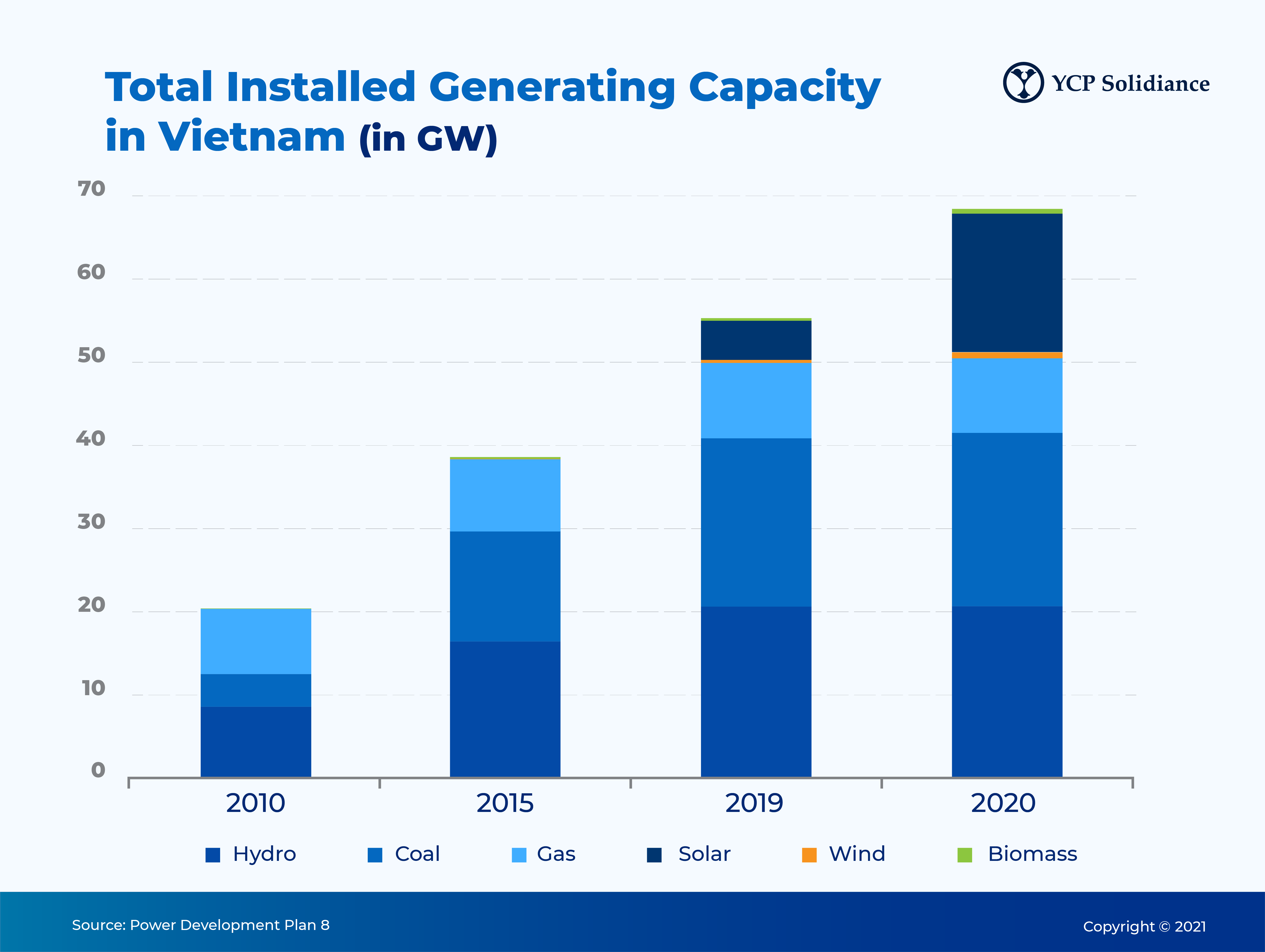

As the Vietnamese economy has grown, renewable energy developments have grown so rapidly that Vietnam became the largest solar energy producer in Southeast Asia in 2020. As a mark of its successful response to the COVID-19 pandemic, Vietnam was one of only a few economies globally to experience positive growth in 2020, nearly 3%. Despite uncertainty about the global economy and its impact locally, the Ministry of Industry and Trade (MoIT) finalized its tariff schedule for solar in early 2020. As a result, Vietnam installed nearly 10GW of solar capacity despite the pandemic and the World Bank has forecasted that the Vietnamese economy will grow nearly 7% in 2021.

The success of attractive policy and the interest from the private sector reached a climax when the country had to begin curtailing grid connections. The rapid growth of generation over the last few years highlighted the aging and inadequate electricity grid and transmission infrastructure and a need to improve and develop it to handle both growing demand and increases in supply. As a result, Vietnam Electricity (EVN) turned its attention to improving and updating its electricity grid and shifting the finance of generation to the private sector. This was boosted further by the passage of the Public-Private Partnership Law in June 2020 which took effect in January 2021 and provided a more complete and more transparent framework for investments to occur. Since then, industry leaders have advocated for the expansion of policy for energy efficiency, growth of renewable energy sources, and incentives for the development of storage.

As a nascent technology, energy storage currently has no specific regulations or legal framework under Vietnamese law as of March 2021. However, any storage infrastructure connected to the grid would likely be characterized as a part of the electricity transmission and delivery system and as a result, subject to regulation under the Law on Electricity and under the regulation of EVN under which EVN has default statutory ownership and management of assets related to the national electricity system, including, but not limited to grid infrastructure supporting facilities like transmission lines. Moreover, at the end of January, EVN has voiced support to the Ministry of Industry and Trade (MoIT) for the development and investment into energy storage opening large opportunities for the private sector.

With one of the highest energy intensities in the world (energy usage to GDP conversion ratio), Vietnam is one of the most energy inefficient countries in the world. This can arguably be a criticism of the energy-intensive industries in the economy and depressed wages of workers, but it is more likely an issue of losses due to both inefficiencies in the transmission system and undocumented electricity theft.

Energy Infrastructure

Private investment and foreign ownership of energy infrastructure assets are allowed depending on the type of activity. For example, private stakeholders can invest in oil and gas infrastructure assets, such as LNG pipelines, import terminals, or storage facilities, but historically, such investments occur under Build-Operate-Transfer (BOT) models with a Vietnamese government counterpart and are subject to PM-level approvals.

The MoIT has publicly expressed support for the development of a clear legal basis and investment scope for private sector ownership and participation in electrical infrastructure and transmission assets. This would principally occur through rushed amendments to the Electricity Law, as discussed in Resolution 55.

Energy Storage Projects

Currently, there are no specific regulations or legal framework under Vietnamese law for energy storage with any storage-type assets connected to the EVN grid likely to be characterized as part of the national electrical system, and as a result, subject to the Electricity Law which gives EVN the rights to ownership and management of national electricity system assets, including grid infrastructure supporting facilities such as transmission lines.

Resolution 55

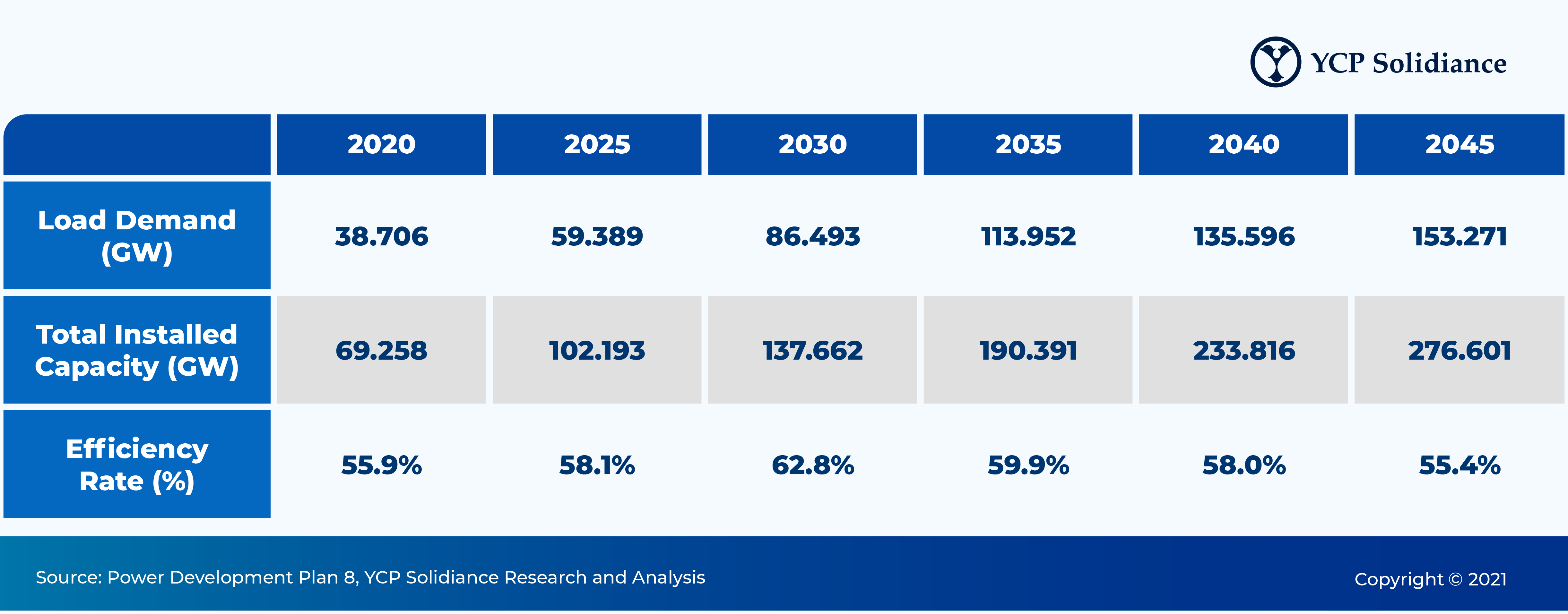

Under Resolution 55, which outlines Vietnam’s energy policy to 2030 with a vision to 2045, the Politburo has specifically committed to encouraging private sector investment and participation in energy infrastructure, acknowledging that current infrastructure systems are incomplete and in need of improvement.

Resolution 55 seeks to introduce a specific mechanism to allow for private capital investments in national power transmission infrastructure and systems with the reduction or elimination of some existing state monopolies through hastened revisions to key legal instruments, including the Electricity Law.

Public-Private Partnership (PPP) Law

The approval of the uniform PPP legislative instrument, the PPP Law, provides a more specific legal framework through which private stakeholders can invest in energy infrastructure projects. The law serves as an additional avenue to potentially invest in energy infrastructure projects beyond any potential forthcoming amendments to the Electricity Law.

The PPP Law covers investments in both power generation assets (e.g. power plants) as well as power infrastructure assets (e.g. transmission lines or grid-connected storage infrastructure). Further guiding Decrees and Circulars are expected to be introduced to provide more specific guidance.

Investors will be able to cooperate with government procurement agencies under several contractual structures, including BOT, Build-Lease-Transfer (BLT), or Build-Own-Operate (BOO). It is anticipated that the PPP Law will also allow investors to self-propose projects.

Case Study: Trung Nam Group

The first privately financed transmission line in Vietnam was commissioned in October 2020. Trung Nam Group, a Vietnamese conglomerate, financed a 17km 220/500kV transmission line, 500 kV transformer sub-station, and associated 450MW solar power project in Ninh Thuan province becoming the first private enterprise to invest in grid infrastructure, with a total investment value of $518 million USD.

The project was developed under a Build-Transfer contractual structure, whereby Trung Nam agreed to transfer ownership to EVN post-construction. The MoIT supported the project and the investment, directly seeking PM-level approval of the project. This potentially created precedent paving the way for future private investment in infrastructure assets in the national grid, particularly for developers that propose construction of energy infrastructure assets that are directly connected to privately-financed power generation facilities.

Authors:

Dennis Lien, Director, YCP Solidiance: Dennis.Lien@ycp.com

Daniel Haberfield, Associate, Duane Morris LLP: DHaberfield@duanemorris.com