The oil and gas industry in Indonesia remains a central component in sustaining its economy, supporting transportation, manufacturing, and industrial activity across the country, even as it steadily broadens its energy mix. While oil and gas now account for a smaller share of GDP than in the past, their role in meeting domestic energy demand remains significant and difficult to replace in the near term.

The more pressing issue facing the sector today is not resource availability, but how effectively those resources move through the system. The structural misalignment across Indonesia’s oil and gas value chain has limited efficiency and constrained value capture. Addressing these frictions is an important step toward building a more resilient and competitive sector.

The Fragmentation Across the Value Chain

Indonesia’s oil and gas system functions as a connected chain, where performance in one segment directly affects the others. In practice, however, investment and reform efforts have often been uneven, creating gaps that limit overall efficiency, even when individual segments show progress.

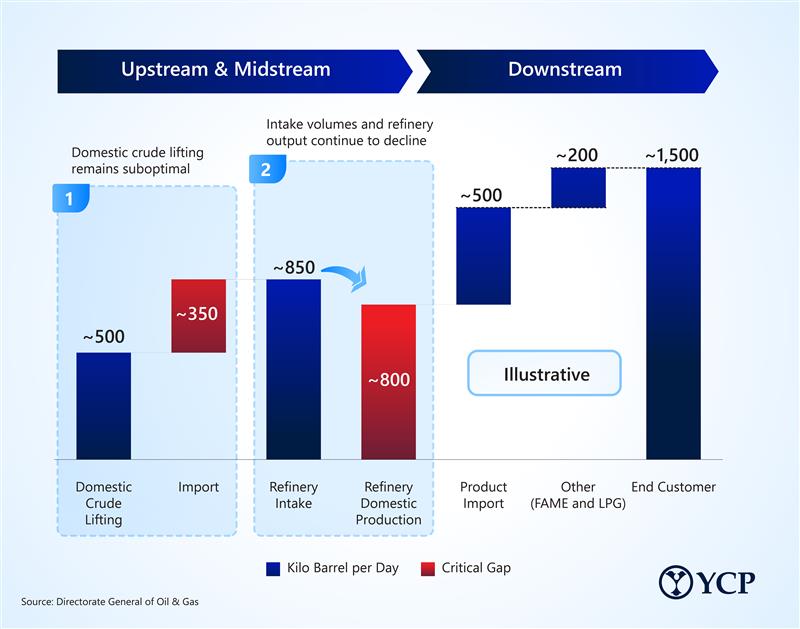

Domestic crude production remains a central issue in the Indonesian upstream oil and gas segment. Output from mature fields has declined over time, while exploration and project development have faced delays. As a result, upstream supply has struggled to keep pace with refinery demand, increasing reliance on imports.

Downstream constraints further complicate this picture. Within Indonesia’s downstream oil and gas segment, many refineries continue to operate with aging infrastructure and limited processing complexity. These limitations reduce efficiency and restrict the range of products that can be produced, particularly as feedstock quality varies across the domestic supply.

Many of the oil and gas sector challenges Indonesia faces today are rooted in long-standing structural conditions rather than short-term market shifts. Aging assets across the value chain, combined with regulatory complexity and extended approval timelines, have made it difficult for projects to move from planning to execution at scale.

In the upstream, declining productivity from mature fields and limited reserve replacement have constrained production growth. Financing and regulatory processes have slowed the development of new exploration and production projects, even where resources are known to exist.

Midstream and downstream constraints further reinforce these pressures. Infrastructure limitations, crude quality mismatches, and older refinery configurations reduce operational efficiency and increase system-wide losses. High utilization rates often hide underlying inefficiencies, translating into higher costs and lower output quality.

Together, these structural constraints explain why incremental improvements have struggled to deliver system-wide gains. Addressing them requires coordinated action across the entire system, rather than isolated interventions in individual segments.

Alignment Across the System

Unlocking the next phase of growth will depend on how effectively capital, policy, and infrastructure are aligned. For oil and gas investment in Indonesia, this is especially important as investors benchmark opportunities against global alternatives with clearer risk profiles.

Ensuring that contract structures and fiscal terms reflect project realities can help reduce uncertainty and improve project bankability, especially long-term investments. Infrastructure planning also plays a critical role. Approaches that link upstream supply, midstream logistics, and downstream processing can reduce inefficiencies and improve overall system performance.

Regulatory clarity is equally important. Streamlined approval processes, clearer timelines, and consistent policy signals can materially improve investor confidence and support sustained investment.

Building Resilience in a Changing Landscape

As the energy transition in Indonesia continues to unfold, the role of oil and gas will remain crucial for years to come. The question is not whether the sector still matters, but how well it can adapt to evolving economic, environmental, and investment expectations while continuing to support energy security.

With coordinated reforms and clearer alignment between policy, capital, and infrastructure, Indonesia’s oil and gas sector can move beyond managing constraints and toward unlocking its full potential. In doing so, it can continue to support economic growth while playing a constructive role in the country’s long-term energy transition.