Consumer behavior worldwide has changed because of COVID-19, bringing about the acceleration of e-commerce's dominance in the retail sector. In the Middle East, this growth is being driven by Saudi Arabia, whose e-commerce industry has grown significantly and has had lasting effects on various other sectors including logistics.

Learn more about the landscape of Saudi Arabia’s e-commerce industry and how it impacts the Kingdom’s robust logistics sector, in this excerpt from our latest white paper, Transforming Saudi Arabia into the Middle East’s Logistics Powerhouse, which you can read in full here.

Mobile shopping in KSA has become a trend with current technological advances and increased smartphone use. In Saudi Arabia, major players were introduced and became popular in the region, such as Souq.com, which launched its app in 2014, and IKEA, who introduced the mobile app in 2013.

To attract more customers, e-commerce companies have introduced features that are extremely attractive to consumers, such as: multi-category product ranges, ratings & reviews, discounted offers, affordable delivery, free exchanges and returns, competitive pricing, and 24/7 availability.

Saudi Arabia is working extremely hard to position itself as a leisure destination, shifting from its conservative model towards becoming a digital nation. For this reason, now is the right time to invest in this evolving market as it will experience unprecedented growth.

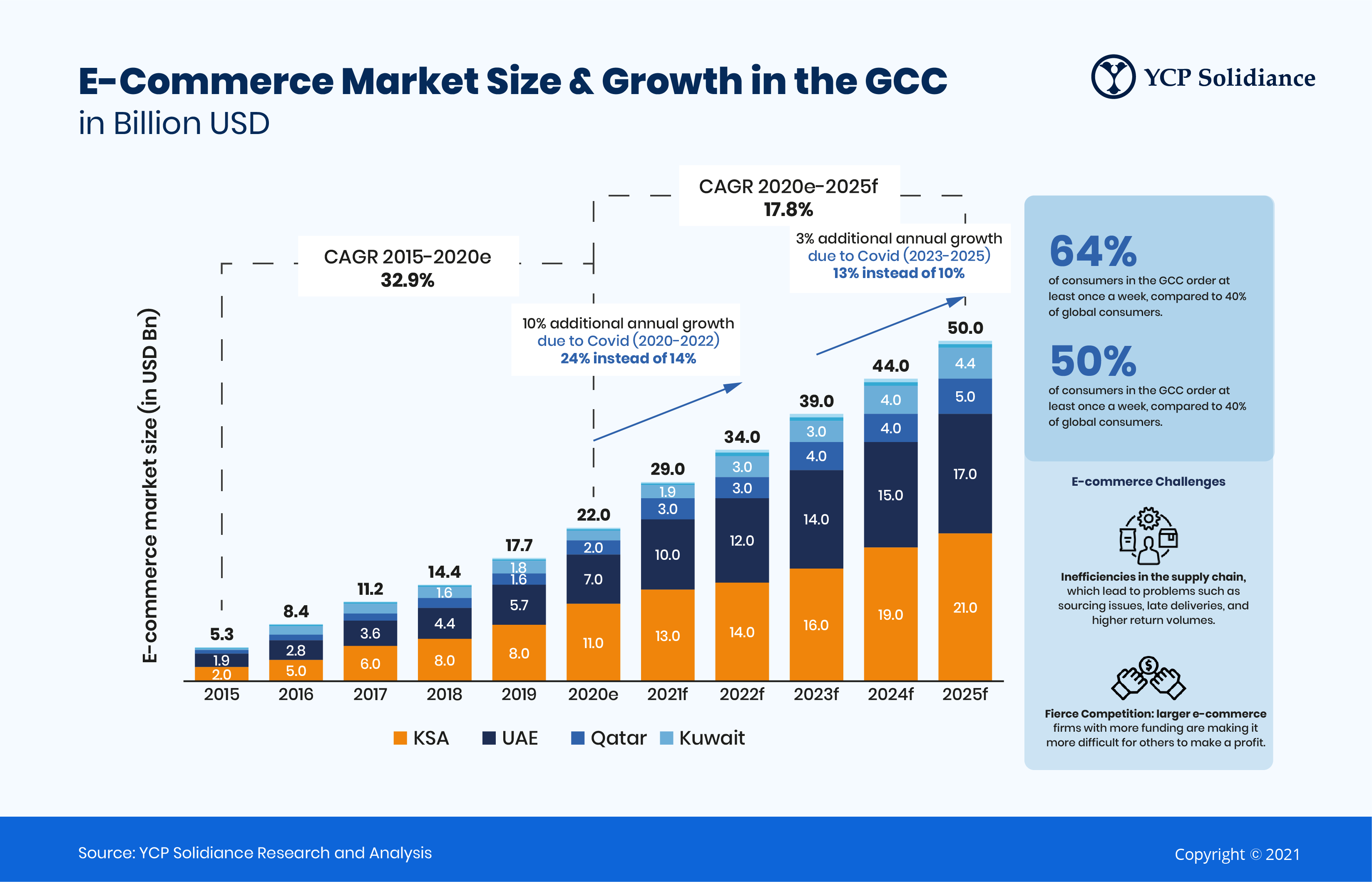

The e-commerce market in KSA witnessed a substantial CAGR growth of 41% from a USD 2 billion market in 2015 to become a USD 11 billion market in 2020. The outbreak of COVID-19 caused an unexpected surge in online shopping, which further increased the forecasted normalized growth rates by an extra 10% from 2020 to 2022, and an additional 3% from 2023 to 2025 to reach a USD 50 billion market by the end of 2025.

Saudi Arabia’s Digitalization Milestones

The pandemic has encouraged many businesses to invest in the e-commerce market, especially since it is expected to contribute to 80% of the retail sector by 2030. In addition, the National Industrial Development and Logistics Program was created aiming to improve KSA’s logistics and transport infrastructure.

E-commerce Market Trends

So far, less than ~1% of logistics businesses are utilizing digital solutions. This gap shows the potential growth of digitalization in Saudi Arabia.

The COVID-19 pandemic is one of the main factors that enabled this market to boom, as clients rely more on touchless and seamless operations. Thus, KSA is making sure to invest further in this sector and to encourage additional players to enter the market.

The e-commerce market grew by 40% from 2015 up until 2020, reaching a value of USD 9.8 billion, with KSA ranking among the top 26 largest e-commerce markets. Saudi Arabia stands out compared to other GCC countries driven by its sizeable GDP, large size, huge population, remarkable purchasing power, high presence of oil and gas, and the wide availability of mineral and metal assets. Moreover, the country has currently the highest number of internet, smartphone, and social media platforms after UAE, with 70% of its population engaging in online shopping.

Finally, KSA has reached an investment of USD 21.3 billion in services and products varying between 45,000 shops and e-commerce platforms. Out of KSA’s total cross-border e-commerce market, 46% is carried out with China.

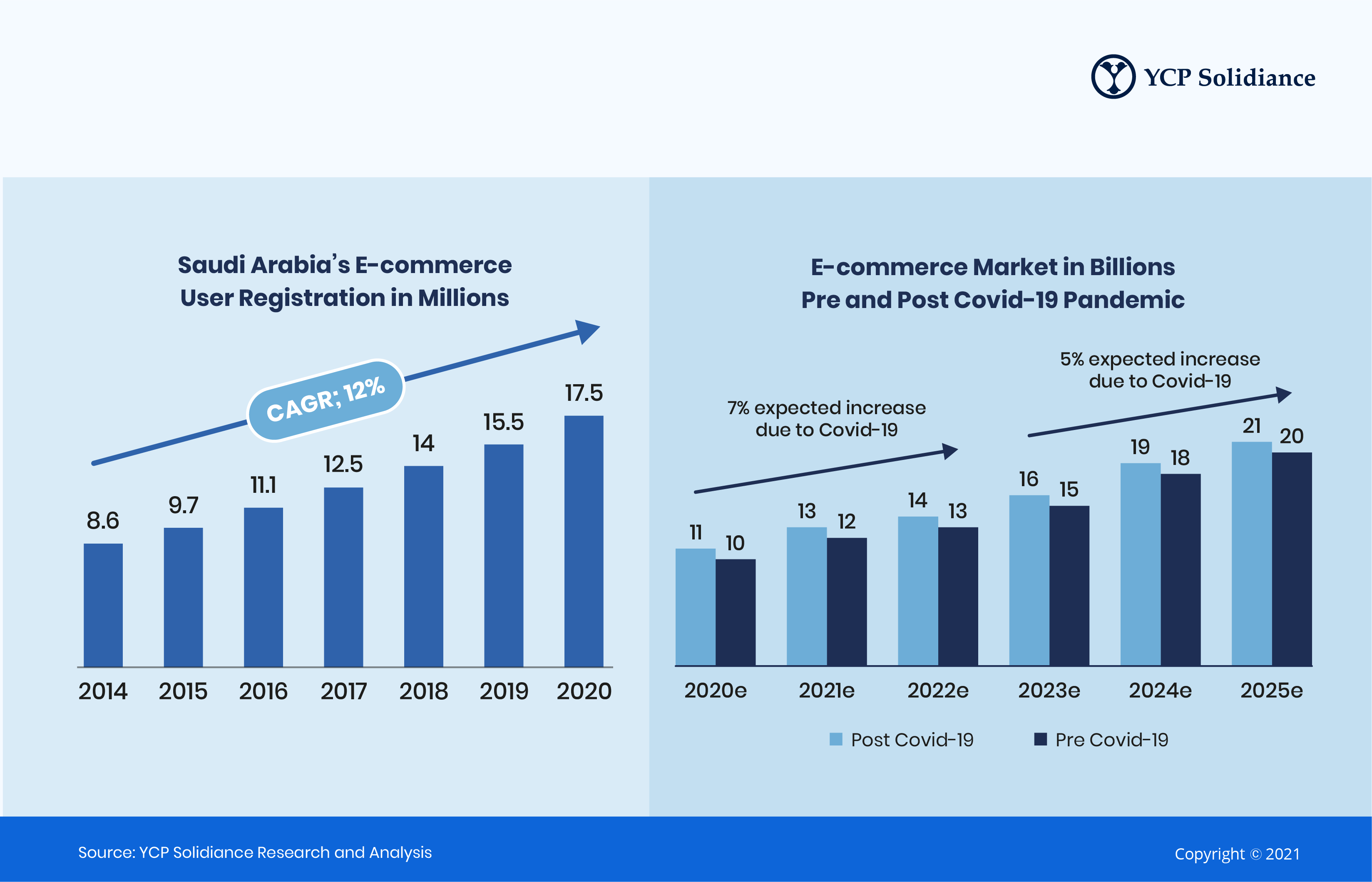

If the e-commerce market forecast before and after the pandemic are compared, between 2020-2022 and 2023-2025, a 7% and a 5% additional growth is expected respectively due to the effects of the pandemic. The long-term effect of COVID-19 has majorly contributed to the growth of the e-commerce market in Saudi Arabia as it is anticipated to surpass a value of USD 21 billion by 2025:

- Saudis have been forced to choose cashless payment options, leading to a newfound confidence in the medium of online shopping.

- E-commerce penetration has reached a record high of 77.4%, and is expected to reach 91% by 2024.

- The share of consumers shopping online more frequently since the pandemic outbreak has increased to reach 48%.

How Amazon Encouraged the E-commerce Ecosystem

About Souq

- Souq.com was founded in 2015. It has now acquired by Amazon and is considered the largest e-commerce platform in the Middle East, having a market valuation of USD 1 billion.

- It managed to implement strategic business decisions and investment technologies, which resulted in the constant doubling of its sales.

- Operations are now in-house, whereas they were previously outsourced to 3PL companies.

Logistics

- It has built its own warehousing operating systems and deployed analytical solutions to track, store, and analyze massive historic data from previous transactions.

- Using AI and machine learning, it managed to have a better understanding of consumer preferences from past sales.

- Forecasting upcoming sales was made possible due to data analytics.

- Simplifying the warehousing and supply chain process through their own manufactured Android device enabled pickers to locate products easily within the warehouse.

- Souq’s “just-in-time” system not only made inventory handling efficient, but also maximized its storage capacity.

Managing Customer Expectations

With the constant growth of the e-commerce industry, the logistics of delivering orders to customers has become more complicated, especially due to COVID-19.

E-commerce has reshaped and simplified the shopping experience for consumers. However, it brings with it new logistical challenges that can be solved through digitalization. In this section, focus is placed on how business owners should operate to meet growing customer expectations.

E-commerce in Saudi Arabia

The significant drivers of e-commerce in Saudi Arabia are the high purchasing power due to high per capita income, improved logistics networks, and rising internet penetration levels.

Saudi Arabia requires effective e-commerce more than ever as consumers are becoming more aware of the available technology, and are now more demanding when it comes to having fast processing interface and a fast delivery time. The Saudi Ministry is working on improving this segment through the e-commerce law in 2019 to motivate online businesses.

Statistics show that most Saudi nationals choose to shop with non-Saudi organizations and prefer to use third-party shops such as Souq.com (which is owned by Amazon, AliExpress which is based in China), and Newegg (which is based in the USA). The reason is that Saudi e-commerce websites are not well-known and do not follow current trends.

For example, Powerstore’s e-commerce offerings are only displayed in the Arabic language and does not serve foreigners. It also doesn’t provide a clear return policy which fosters skepticism in consumers.

Saudi nationals choosing an e-commerce platform are concerned with seamless navigation through the platform or application, fast download time, and attractive, straightforward UX design.

Customer expectations are becoming hard to meet using traditional logistics. Companies like Aramex, Al Majdouie, DHL and many more are relying on digitalization as consumers turn to e-commerce to shop for their everyday needs. This phenomenon requires a fast response from the logistics and supply chain.