As part of the Kingdom of Saudi Arabia’s push to become a global logistics provider, the country has employed several strategies: for instance, as part of Saudi Vision 2030, the KSA launched the National Transport and Logistics Strategy to boost the development of their transportation and logistics industries both domestically and globally.

Such strategies do not only set forth concrete solutions and frameworks to increasing Saudi Arabia’s global presence, but it also presents several promising investment opportunities for those looking to enter the Saudi logistics industry.

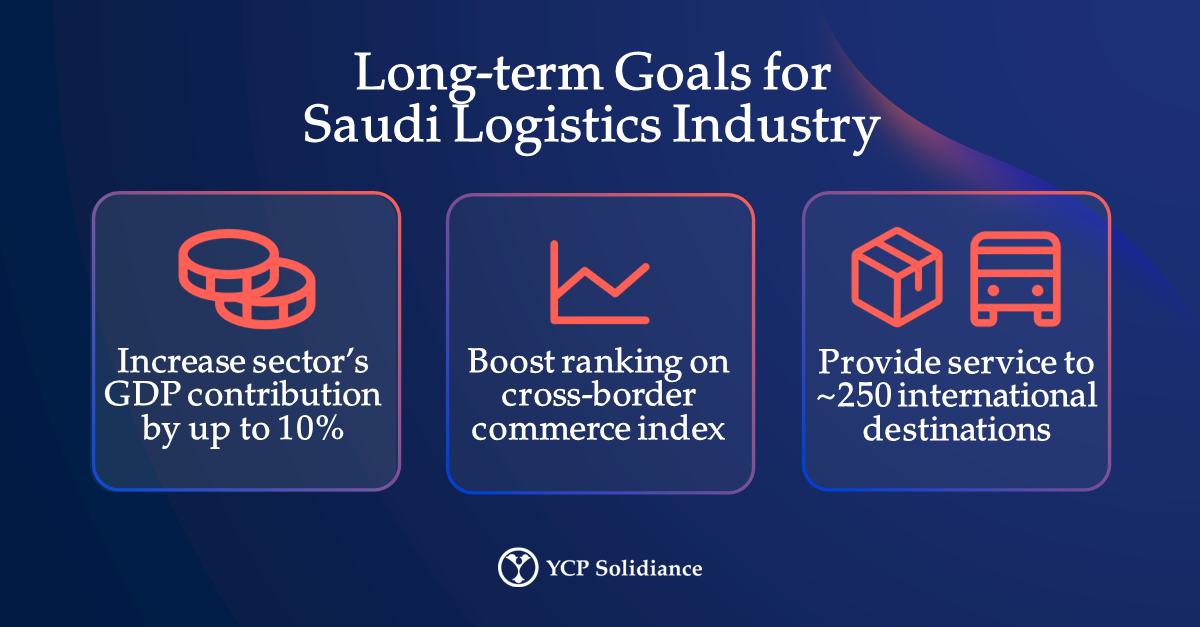

Transforming the Saudi Logistics Industry

According to the YCP Solidiance white paper “Transforming Saudi Arabia into the Middle East's Logistics Powerhouse,” data revealed that Saudi Arabia currently boasts the most extensive transportation and logistics market in the Middle East and North Africa (MENA) region as evidenced by its 27.6 billion USD recorded value in 2020. Although Saudi Arabia already accounts for 43% of total value generated in the Gulf Cooperation Council (GCC), market trends suggest that there is still room for further growth wherein infrastructure, digitalization, and an emphasis on e-commerce and the start-up ecosystem have major roles to play.

For the KSA to further strengthen its logistical capabilities on a global scale, it will first need to address current weaknesses in the three aforementioned areas. Regarding logistical infrastructure, several new logistics zones wherein transportation of goods to shipping ports are concerned have been designated in the country to improve supply chain management. Moreover, there currently exists an opportunity to optimize logistical operations via digitalization through the application of solutions like robotics, artificial intelligence, and digital warehouse management systems. Meanwhile, businesses situated in the logistics and transportation industries can also capitalize on the increased demand brought about by the emerging e-commerce and start-up ecosystem in the KSA.

In consideration of these three key areas, the opportunities for foreign and domestics parties alike to involve themselves in the transformation of the Saudi logistics industry is clear. As interested parties continue to explore these promising business opportunities, it is likely that Saudi Arabia will further cement itself a powerhouse logistical hub across the globe.

Saudi Vision 2030

Recognizing the potential that its logistics and transportation industry has on the global stage, the government has been heavily involved in promoting industry-wide accelerated development. Perhaps the most significant strategy that the Saudi government has employed has been Saudi Vision 2030 wherein less reliance on oil and gas across all industries is the main objective.

Under Saudi Vision 2030, the government has also championed an increase of foreign investment by introducing enticing benefits for potential entrants. In the YCP Solidiance white paper, “Partnering for Success in Saudi Arabia Construction,” several conditions favorable to foreign contractors are discussed. For example, the Saudi government utilizes standardized contracts for both local and international contractors, while also minimizing possible penalties incurred by capping it at 20% of contract value. Although these terms are seemingly favorable only to those operating in the construction industry, it can also be beneficial to logistics players as it is a closely related industry. Further, it is indicative of the government’s proactive efforts as guided by government initiatives like Saudi Vision 2030.

Overall, the current market trends suggest that the logistics and transportation industry in Saudi Arabia will continue its accelerated growth. Eventually, this growth will directly translate to improved logistical capability that will then position Saudi Arabia as a global logistics provider.

To get further insight and understanding on other industry trends that present promising investment opportunities across the world, subscribe to our newsletter here and check out these reports: