Indonesia’s 12th IndoEBTKE Conference was held last July, advancing topics on renewable energy, technology, and policy among key stakeholders. Throughout sessions, one issue remained central: how to finance the energy transition—particularly where funding will come from and how it can be mobilized.

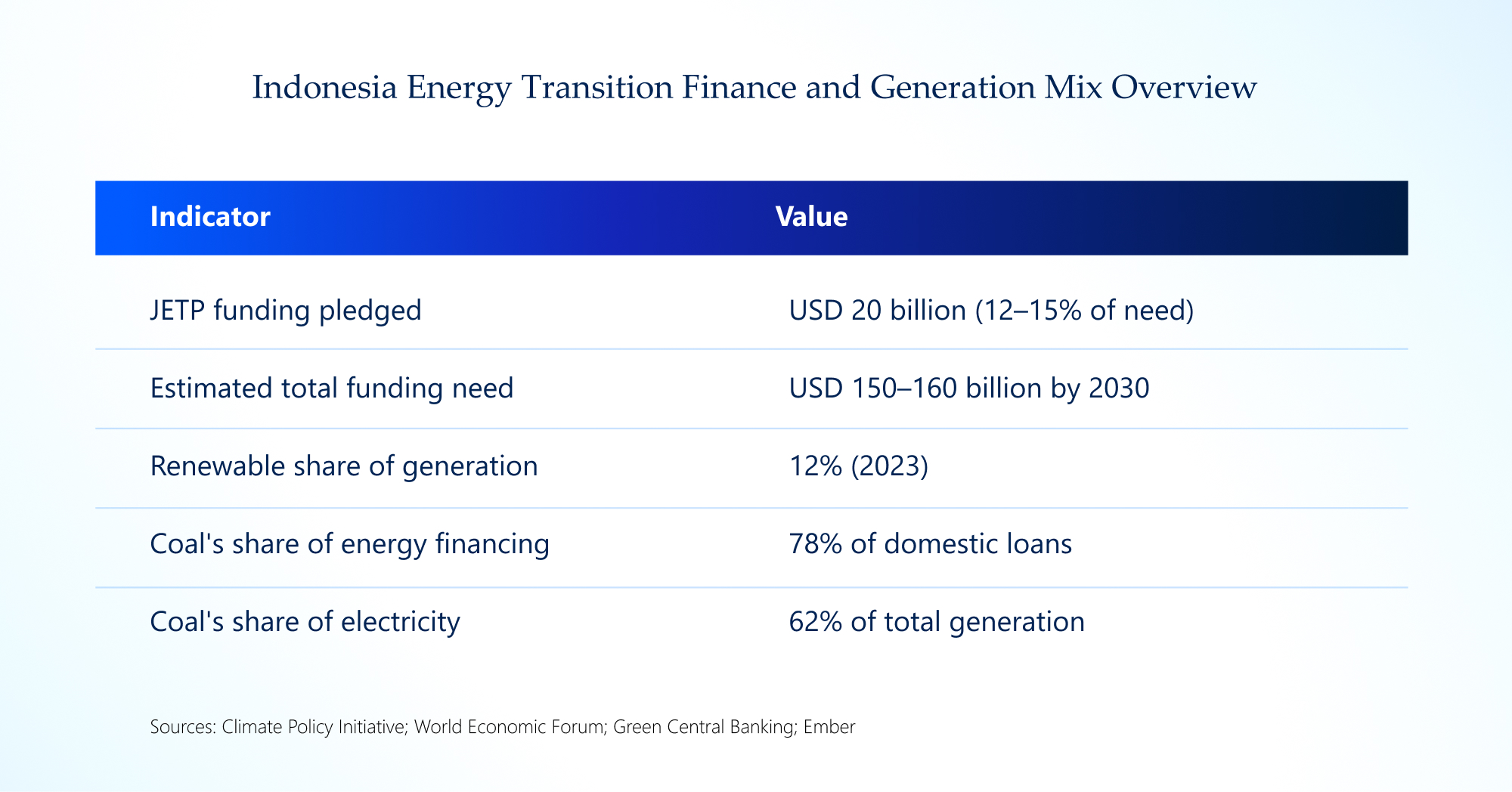

Financing lies at the core of Indonesia’s climate initiatives, with the nation aiming to reduce emissions by 31.8% by 2030 (or up to 43.2% with international support), and achieve net-zero emissions by 2060. The International Energy Agency (IEA) provides a benchmark for the scale of financing needed to meet these goals: an estimated USD 150-160 billion in cumulative investment to decarbonize the energy sector by 2030. While Indonesia is already making headway, with a USD 20 billion pledge through the Just Energy Transition Partnership (JETP), this covers only 12-15% of the total need, leaving a vast financing gap.

Meeting the IEA’s 2030 target is not only a national imperative but a global responsibility, highlighting the urgency of Indonesia’s green energy transition. Without alignment between sector and capital, domestic initiatives risk fragmentation and underperformance.

The Energy Financing Gap

Compared to its ASEAN peers, Indonesia faces one of the region’s largest sustainable financing gaps, driven by its coal dependency and growing energy demand. This dependence is reflected in the current energy mix, where coal still accounts for roughly 62% of electricity generation, while renewables contribute only around 12%. Domestic lending remains skewed toward fossil fuels, with nearly 78% of energy loans flowing into coal-based projects in 2023, and renewables accounting for less than 10%.

The Strain of Underfunding

The gaps remain visible across sectors. Off-grid solar projects in Eastern Indonesia, which could provide electricity to remote villages, often stall at the feasibility stage as local developers struggle to secure bank loans. Waste-to-energy plants in Java, despite strong policy backing, face uncertain cost-recovery structures. Even biofuel expansion under B35 and B50 mandates has yet to attract sufficient financing beyond large-scale palm refiners.

This challenge is not unique to Indonesia. Globally, many projects fall into what the Stanford Social Innovation Review calls the "missing middle"—initiatives too large for microfinance but too risky for commercial banks. Without dedicated mechanisms to address this gap, promising projects remain on hold.

Failing to close the financing gap risks delaying Indonesia’s energy transition—prolonging coal dependency and raising the costs of decarbonization efforts. This can undermine Indonesia’s climate credibility, deter both foreign and domestic investment, and impact public health and economic stability. These risks highlight the critical need for swift financial mobilization and coordinated policy action.

Global Models That Work

Lessons can be drawn from other markets. The IEA emphasizes the implementation of innovative financial instruments and risk-mitigation strategies aligned with global standards to bridge the gap.

- In Singapore, Temasek has shown how catalytic capital can derisk early-stage projects, with each concessional dollar attracting USD 4-5 of commercial investment.

- A case study by the Council of Inclusive Capitalism further highlights how Temasek designed impact-linked finance to scale climate projects while delivering measurable social benefits.

- Chile demonstrated how sovereign green bonds, paired with partial guarantees and transparent metrics, could open the door to institutional capital.

- Vietnam, through clear feed-in tariffs, attracted USD 7.4 billion in solar investment within two years.

- Even Indonesia offers proof of concept: its sovereign green sukuk program has mobilized more than a billion dollars for geothermal projects, reducing CO2 emissions by millions of tons.

The common thread across these examples is structure: clarity in risk-sharing, predictability in returns, and transparency in reporting.

A Financing Blueprint for Indonesia

For Indonesia, the blueprint must be both tailored and pragmatic. The IEA recommends leveraging catalytic and blended finance to mobilize both public and private investment, closing the “missing middle.” Catalytic capital should be embedded within blended finance platforms, housed in institutions such as INA or PT SMI, where concessional layers can attract both DFIs and commercial banks. At the same time, developing a strong renewable energy financing mechanism—including the expansion of green bonds and sukuk beyond sovereign issuances to municipalities and corporates—can give local players access to ESG-driven capital.

Public-private partnerships, meanwhile, require a clear allocation of risks and rewards. Tariffs, offtake guarantees, and performance clauses must be structured with investor confidence in mind. Investors consistently seek regulatory certainty, transparent reporting, and risk-sharing mechanisms—factors which reduce perceived risks and help unlock the capital needed to build green infrastructure.

Finally, financing flows must be tied to national milestones such as RUEN and JETP, giving markets the regulatory certainty they demand. Equally important is the reinforcement of ESG standards—evolving from box-ticking compliance toward credible third-party certifications can reduce the cost of capital and unlock premium offtake agreements.

Ultimately, meeting IEA's 2030 targets requires embedding such structured financial solutions directly into Indonesia's national policy framework. When financing mechanisms are harmonized with the IEA's climate-aligned investment criteria and global best practices, Indonesia can unlock a broader pool of sustainable capital, enabling accelerated decarbonization pathways.

The Path Forward

Financing the green transition is more than just closing funding gaps—it’s about shaping Indonesia’s economic future. Every dollar mobilized today should build domestic capability, strengthen investor trust, and secure Indonesia’s position within global supply chains.

The global pool of sustainable capital is already vast. The real challenge is designing the right financial structures to channel it effectively—toward projects that generate both measurable climate impact and long-term competitive advantage for the Indonesian economy.

With catalytic finance, transparent instruments, and strong public–private collaboration, Indonesia can not only catch up but also set the standard for sustainable investment in Southeast Asia.

At YCP, we believe Indonesia’s green transition is more than a climate initiative. It is an opportunity to redefine resilience, competitiveness, and leadership for the next generation of growth.

References

- Climate Policy Initiative. (2023, August). Landscape of Indonesia power sector finance. https://www.climatepolicyinitiative.org/wp-content/uploads/2023/08/CPI-2023_Landscape-of-Indonesia-Power-Sector-Finance-FINAL.pdf

- Larasati, L. K., & Mafira, T. (2023, December 5). Highlights from Indonesia’s JETP Comprehensive Investment and Policy Plan. Climate Policy Initiative. https://www.climatepolicyinitiative.org/highlights-from-indonesias-jetp-comprehensive-investment-and-policy-plan/

- Rangelova, K., & Setyawati, D. (2024, July 1). Indonesia and the Philippines coal dependency surges past China and Poland. Ember. https://ember-energy.org/latest-insights/indonesia-philippines-coal-surges-past-china-poland/

- Thomasson, E. (2025, May 13). Indonesia sends mixed messages on coal phaseout. Green Central Banking. https://greencentralbanking.com/2025/05/13/indonesia-sends-mixed-messages-on-coal-phaseout/

- World Economic Forum. (2022, November). Policy opportunities to advance clean energy investment in Indonesia. https://www3.weforum.org/docs/WEF_Policy_Opportunities_to_Advance_Clean_Energy_Investment_2022.pdf