"Industrial downstreaming is Indonesia’s pathway toward Golden Indonesia 2045—where global competitiveness and national prosperity converge."

- President Prabowo Subianto (OECD Development Report, May 2025)

Indonesia’s industrial downstreaming initiative is among Southeast Asia’s most ambitious industrial campaigns. The country’s Ministry of Investment reports that since 2020, it has attracted USD 79 billion in investment and also created more than 594,000 jobs in Q1 2025. According to BPS, it also lifted nickel exports to USD 33.58 billion by the end of 2023. Mining and refining now account for 23% of total foreign direct investment (FDI) inflows.

Downstreaming refers to processing raw commodities into higher-value products domestically — for instance, refining nickel into EV battery components — to capture more value locally and strengthen economic sovereignty.

Still, growth masks a structural gap: Indonesia is building capacity but often not capturing control. According to the International Energy Agency, Indonesia's EV battery production capacity is only at 0.4% of the global total, despite holding 22% of global nickel reserves. The OECD and ERIA estimate that nearly 42% of mining joint venture (JV) profits are repatriated offshore each year, reflecting limited technology transfer and restrictive licensing. One exception is Freeport’s USD 3.7 billion copper smelter in Gresik, which retains around 34% of the value chain margin domestically through stronger control of processing technology, but such cases remain rare.

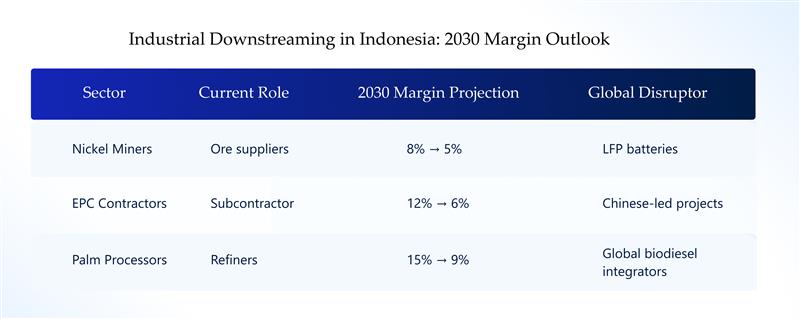

The Disintermediation Threat: Margin Pressures

Without deeper domestic participation, industrial downstreaming risks reinforcing dependency. Margins are already under pressure across major sectors.

ESG: A Lever for Negotiation

Amid these risks, ESG standards are emerging as a bargaining tool. Rather than a compliance burden, credible ESG alignment increasingly determines financing terms and ownership opportunities. A Transparency International audit in 2024 scored Indonesian mining companies just 0.31 out of 10 on anti-bribery measures. In 2025, the Ministry of Environment revoked four nickel mining permits in Raja Ampat for ecological violations.

Conversely, the Financial Services Authority (OJK) and LPEM UI report that firms with strong ESG performance access loans 1.5–2% cheaper. In Halmahera, an IRMA-certified nickel mine cut foreign ownership from 80% to 49% by attracting green financing. As Finance Minister Sri Mulyani remarked: “ESG is not a sacrifice — it’s a smart policy.”

Blueprint for Sovereignty: Four Strategic Shifts

Indonesia needs to implement long-term economic sovereignty solutions to move from participation to ownership. Four strategic shifts are critical:

1. From Royalties to Technology Ownership

Joint ventures must embed technology transfer clauses. In energy, knowledge-sharing obligations should be tied to biomass and coal-to-gas projects. In metals, local consortia must negotiate access to cathode processing and smelter IP.

2. Redirect State Capital Toward Innovation

Of Danantara’s targeted USD 900 billion in capital deployment, most has gone to physical infrastructure. Future phases must emphasize R&D and intellectual capital, especially in EV batteries, biofuels, and renewable chemicals.

3. Turn ESG Into Negotiating Power

Certifications such as IRMA and EITI are becoming global prerequisites. Firms aligning with these standards can renegotiate JV terms, improve export credibility, and unlock concessional loans.

4. Build Integrated Domestic Capabilities

Local firms must transition from subcontractors to full-spectrum participants, spanning capital, technology, and compliance. This includes vertical integration in agroindustry and mining, as well as stronger ESG governance.

“To create lasting downstream value, local businesses must own the technologies they operate, the capital they deploy, and the sustainability standards they meet. Without these, we risk remaining perpetual subcontractors in our own economy.”

- Dhendy Rizki Fadhillah, Partner, YCP Indonesia

Moving from facilitation to ownership requires more than equity negotiations in joint ventures. Local firms must also build internal R&D capacity, financial autonomy, and independent ESG governance models to sustain long-term competitiveness.

Key priorities include:

- Energy & Mining: Provide structured training and technology transfer programs so local firms can adopt, adapt, and improve operational technologies — not merely operate them.

- Manufacturing & Agroindustry: Strengthen vertical integration by linking raw material producers directly with processing facilities, ensuring more value is retained domestically.

- Finance & Compliance: Incentivize banks and venture capital to fund ESG-rated SMEs and mid-tier players, tying financing to ownership and governance benchmarks.

By embedding these capabilities, Indonesian firms can secure greater resilience and ensure that industrial downstreaming translates into durable economic sovereignty.

Opportunities Emerging for Local Businesses

Despite challenges, Indonesia’s downstreaming agenda is opening space for domestic firms:

- Biofuel and palm-based hubs in Sumatra and Kalimantan, driven by B35 and B50 mandates.

- EV component clusters in Central Java and North Maluku, projected to expand between 2025 and 2030.

- Agri-processing zones for cocoa, seaweed, and spices, supported by halal certification and export incentives.

- Logistics and EPC services across nickel corridors in Sulawesi and Halmahera, increasingly tied to ESG audits and local sourcing.

These zones present growth pathways not only for multinationals but also for SMEs, cooperatives, and family conglomerates.

Firms considering entry into Indonesia’s industrial downstreaming economy should assess their preparedness against five critical questions:

- Resource Access: Do you control or have reliable access to local raw materials or supply inputs?

- Consortium Participation: Can your firm join or build a credible industrial consortium to strengthen bargaining power?

- ESG Readiness: Are you prepared for ESG audits and pursuing third-party certifications to meet global standards?

- Policy Leverage: Have you tapped into government-linked incentives such as Danantara, KUR financing, or fiscal R&D support?

- JV Governance: Do you fully understand the intellectual property, equity, and compliance clauses embedded in joint venture agreements?

These checkpoints determine not only whether firms can participate, but whether they can secure meaningful and sustainable ownership in the downstream economy.

Conclusion: Prioritizing Ownership

President Prabowo’s 8% growth target depends on Indonesia not only processing more resources but also owning the value chains they create. Industrial downstreaming could add USD 120 billion to GDP by 2030, but the critical question is who captures the margins, technology, and innovation capacity.

Foreign capital and partnerships will remain vital. Indonesia’s long-term prosperity, and the vision of Golden Indonesia 2045, requires ensuring that global investment translates into domestic control, competitiveness, and sustainable growth.

Downstreaming is not just economic policy. It is a sovereignty challenge.