Interest and participation in financial technology (fintech) are increasing dramatically in various parts of the world, and such development has extended to countries in Asia. Specifically, Thailand’s fintech sector has increased, and several significant advancements have been made. The success Thailand’s fintech sector has achieved thus far is expected to translate well in 2023.

Propelling Growth Via Public Sector Initiatives

In Thailand’s fintech industry, the public sector has played a significant role in developing the market as involved parties are constantly exploring fintech initiatives.

For instance, the Bank of Thailand (BOT)– the country’s central bank – is further developing its fintech-based services. Initially launched in January 2018, the BOT created ‘PromptPay,’ a fintech application that facilitates cashless transactions within the country. In recent years, the service has also developed to support payments in other countries like Laos, Cambodia, and Vietnam, to name a few.

Hoping to replicate such success and capitalize on the fintech trend, the BOT is now seeking to establish a separate fintech payment system that facilitates international transactions. Moreover, Thailand’s government is also engaged in several other fintech endeavors, like the issuing of its very own retail central bank digital currency (CBDC) and experimenting with a peer-to-peer (P2P) loan lending system.

Although the public sector’s interest in fintech has been primarily motivated by the desire to catalyze economic recovery, it is essential to highlight that continued investment in fintech-related projects will stimulate the growth of the financial technology industry’s ecosystem.

Predicting the Future of Fintech in Thailand

Due to the growing demand and popularity of financial services in Asia, fintech firms in Thailand and their digital banking services are expected to grow rapidly in 2023. Financial organizations and non-banks operating across several industries will spearhead financial technology innovation. Entities like retailers, telecommunications, and tech companies are expected to play a significant role in the growth of fintech.

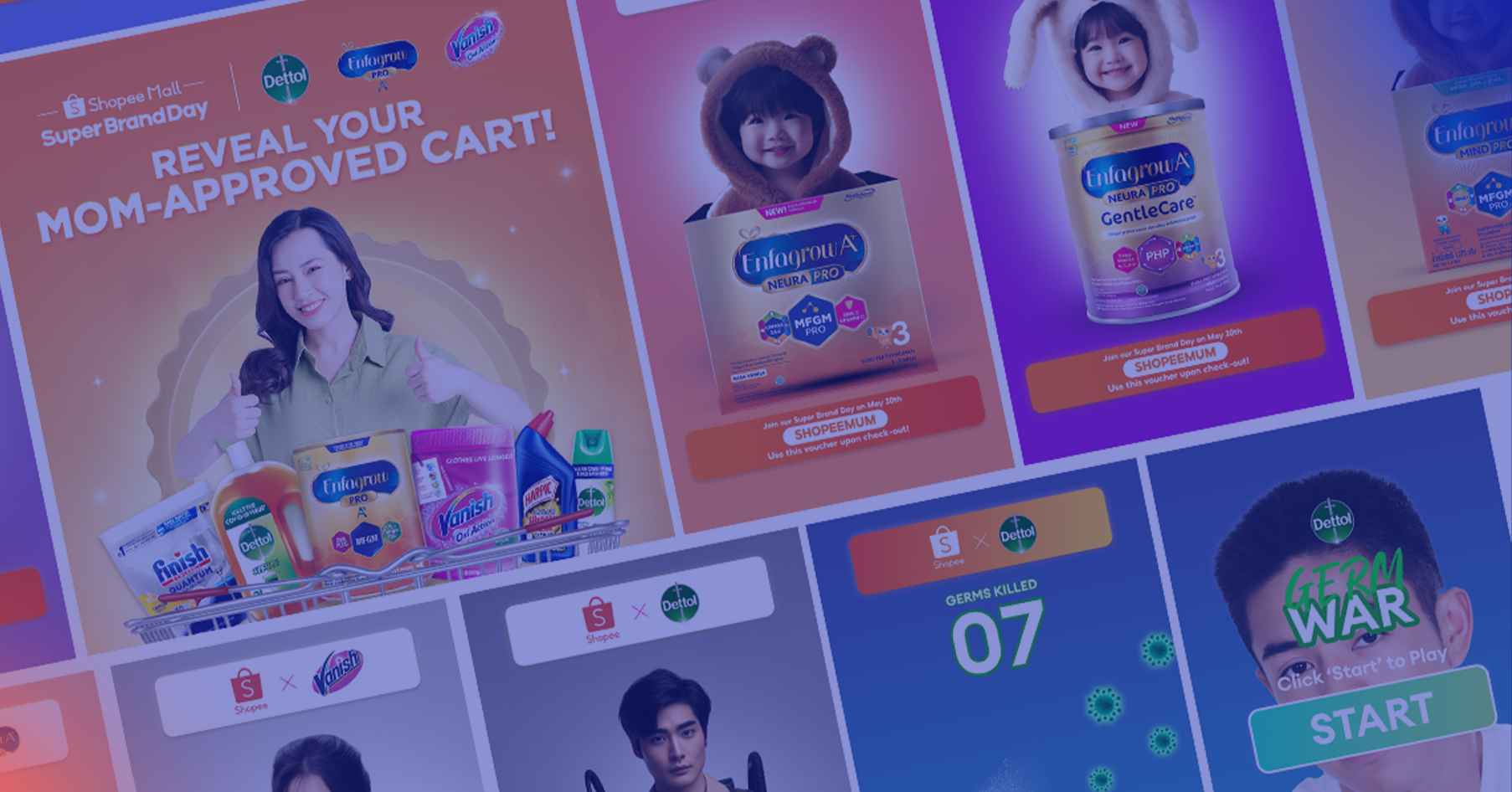

Several instances of non-banking companies from other industries, like tech, have successfully entered Asia’s banking industry. These companies include but are not limited to Grab and Sea Group, both of whom have incorporated fintech into their respective ventures. As the operator of its super-application, Grab developed an e-wallet to facilitate transactions within the application’s services ecosystem, like transportation and food delivery. Likewise, Sea Group has also developed a digital wallet system for customers who use its e-commerce platform Shopee.

These companies’ successes indicate that fintech is on the fast track to success, and further growth should be expected. The advancements also reflect the enormous potential of fintech as it can leverage several technological tools to accelerate development. As per the Bangkok Post, fintech is expected to incorporate further and rely primarily on cloud-based technology as it offers several advantages, such as financial inclusivity and flexibility in execution.

Although the fintech industry in Thailand is still in its early stages, several promising investment opportunities exist for market stakeholders. Since many players are interested in entering the fintech space, players should capitalize early and seek out potential partnerships. In 2023, expect Thailand’s fintech industry to continue its growth via interest from both public and private sector entities.

To get insight into the fintech industry, its growth, and how the market is expected to develop in Asia, subscribe to our newsletter here and check out these reports: