Emerging trends in Thailand’s electric vehicle (EV) market reflect a promising momentum towards electrification across different vehicle segments, supported by the country's comprehensive automotive supply chain as a solid foundation. This article will delve deeper into Thailand's EV market and the potential opportunities onwards.

The Latest EV Market Trends in Thailand

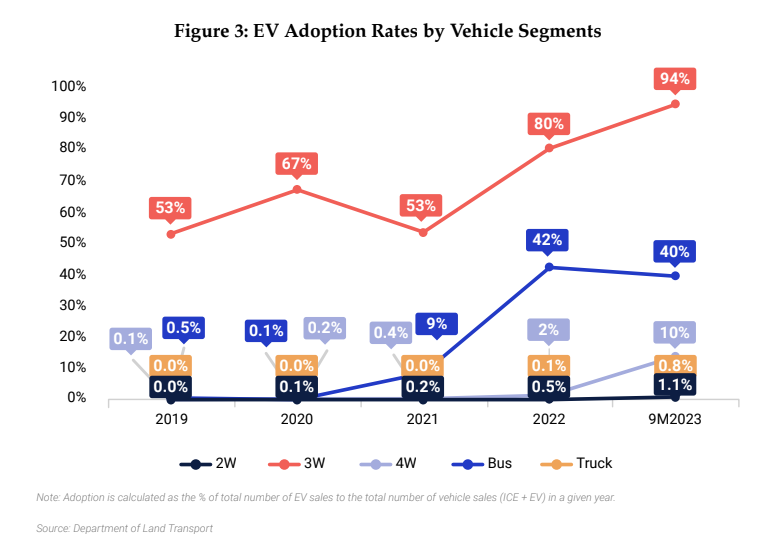

The country's notable adoption of EVs lies in the passenger EV segment, which experienced rapid expansion. The adoption rate of this segment reached a significant milestone of 10% by September 2023. This trend signifies a shifting consumer preference towards eco-friendly transportation options, indicating a promising trajectory for EVs in the passenger vehicle market.

In addition to passenger vehicles, the emergence of electric three-wheelers (3W) has contributed to Thailand's EV landscape diversification. Introducing electric 3W taxi services, such as MuvMi, has spurred growth in this segment. Plans to expand the fleet of electric 3W vehicles, particularly in urban areas like Bangkok, suggest a sustained upward trajectory for adoption in this sector.

Furthermore, the government's initiatives in converting public transport buses to electric fleets have yielded significant results. The adoption rate of EV buses increased from 9% in 2021 to an impressive 42% in 2022, driven by efforts to enhance sustainability in public transportation. As the government extends its fleet conversion initiatives beyond urban centers like Bangkok, more private sector players, including university and employee buses, are expected to transition to EVs, further propelling adoption in the bus segment.

Opportunities in the EV Market in Thailand

The rapid growth of Thailand's EV market presents many investment opportunities across the entire value chain. There is a burgeoning demand for EV components and infrastructure from automotive parts suppliers to battery manufacturers. With the government's ambitious targets for EV adoption and supportive policies and incentives, the automotive supply chain is gearing up to meet the escalating demand for EVs and related components.

Additionally, Thailand boasts a growing charging infrastructure network as of May 2023, with 2,833 AC chargers and 1,795 DC chargers spread across the country. However, there's still ample room for growth, particularly in expanding fast charging stations. With the government targeting the installation of 12,000 fast chargers by 2030, there's a pressing need for investment and expansion in this crucial area to support the burgeoning EV market.

Thailand also surges innovation in digital services. With multiple charging station brands and fragmented booking/payment systems, there's a growing demand for integrated mobile applications that streamline the charging process. Such apps would simplify charging station location and reservation and provide real-time queue status information, optimizing the charging experience for EV drivers.

To get further insight into emerging business trends emerging in Asia's markets and beyond, subscribe to our newsletter here and check out our latest reports below: