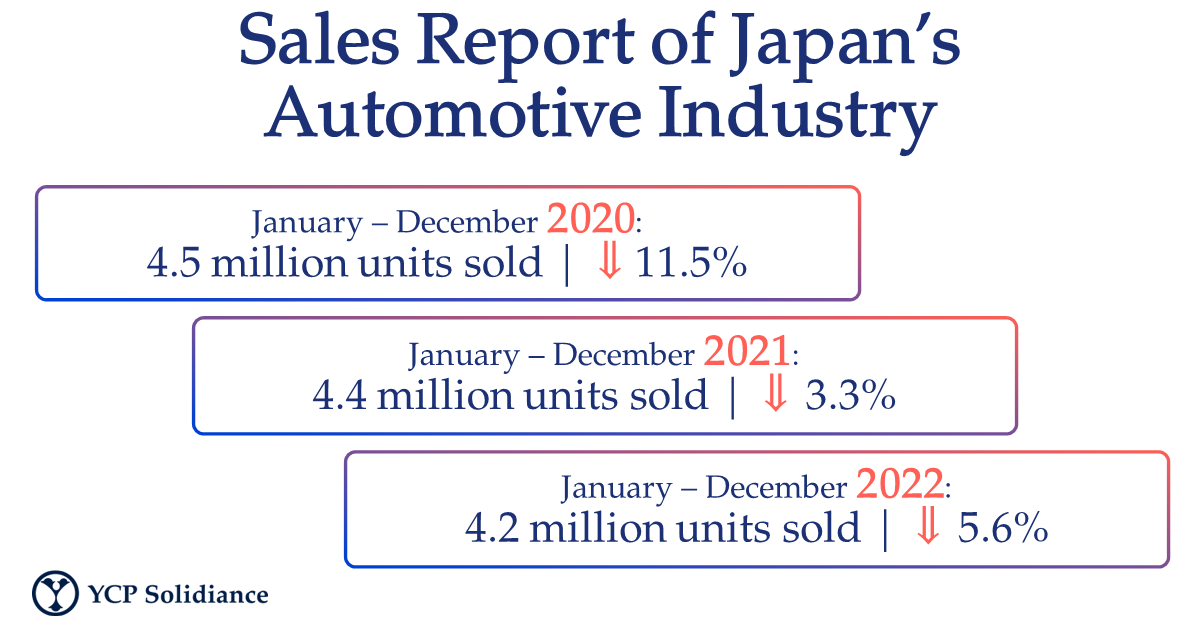

Per a January 2023 report by Nikkei Asia, Japan has officially lost its position as the world’s third-largest automotive market, with India surpassing it in terms of automotive sales in 2022; preliminary data estimates that India totaled 4.25 million units, while Japan managed a close 4.2 million.

Although this is an encouraging indicator for the automotive industry in India, such a development could be disheartening for Japan’s automotive sector and its stakeholders. Moving forward, what is the outlook for the automotive industry in Japan?

Overview of the Automotive Industry in Japan

In a global context, Japan’s automotive industry is still relatively prosperous compared to other countries, as it is still the fourth-largest automotive market worldwide. Over the years, Japan’s automotive sector has also performed well internationally but has faced difficulties due to shortages in semiconductor chips, an essential part of the automotive production process.

Despite the supply chain challenges like the chip shortage, the automotive industry remains one of Japan's most prominent domestic industries. The country is home to several well-known automotive manufacturers with renowned reputations for producing high-quality, reliable vehicles, such as Toyota, Honda, and Nissan.

While regaining its status as the third-largest automotive market would still hold some degree of importance, the Japanese automotive market should also focus on diversifying its efforts, as doing so may attract more attention from domestic and foreign investors. Eventually, the increased interest will naturally translate to a larger sales volume, which will help Japan reclaim its previous position in the global rankings.

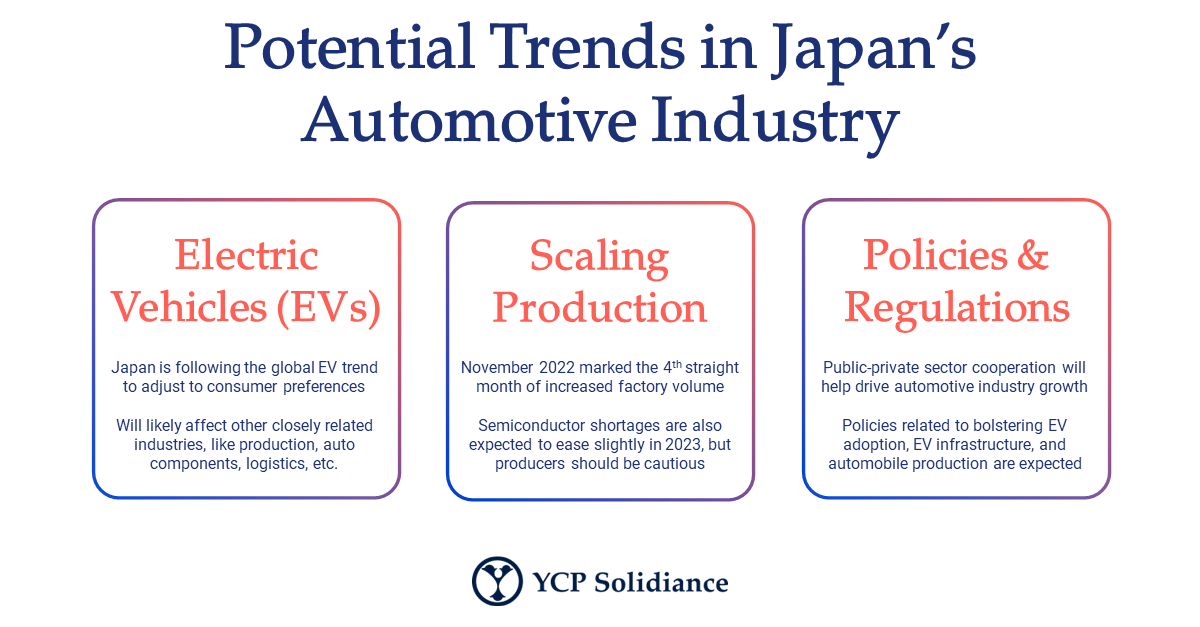

New market entrants and current stakeholders of the Japanese automotive industry can catalyze market growth by exploring several automotive trends, like electric vehicles (EVs) and automobile production revitalization, as they will likely generate the most investment interest. Given that the nation’s transition toward endemicity is attracting more business across several industries, automotive companies should capitalize and actively seek partnerships or collaborations with potential investors.

Outlook of Japan’s Automotive Industry

For instance, according to a Bloomberg report on the Japanese automotive market, research reflected that no Japanese carmaker had made the global top 20 EV makers by vehicles sold. This is concerning as EV data from the first three quarters of 2022 indicated that battery-powered vehicle sales increased by 80% compared to 2021, indicating EVs’ rapid growth and popularity.

Thus, leveraging the electric vehicle trend will help benefit the Japanese automotive industry as it serves three primary purposes: (1) acceleration of EVs– an area that was previously perceived as an industry weakness, (2) signaling to international parties that the country is primed for EV investment, and (3) re-entry into the EV segment which will further solidify their strength as one of the biggest automotive markets in the world.

From a larger perspective, Japanese automakers and industry leaders should consider how automotive trends will inform other parts of the industry. For example, EV acceleration will significantly impact automotive production as the EV process has different requirements than traditional automobiles. To avoid any adverse effects that automotive trends like EVs may have on the production industry, part manufacturers will need to pivot and adjust their strategies to accommodate the needs of EV assemblers.

Regardless of how automotive players in Japan will catalyze industry growth, it will be essential to ensure that public-private sector collaboration takes place. Parties from both sides will need to make collective decisions that guide and foster holistic growth. This can be achieved through several methods, such as government policies that excise tax breaks or exemptions for automotive production or even partnerships between government offices and automakers to improve automotive infrastructure in the country. Such collaboration will further ensure the success of Japan’s automotive industry this 2023.

To get insight into how other automotive industry trends are expected to impact businesses within the market, subscribe to our newsletter here and check out these reports: